In the heart of a bustling fiscal quarter, Costco made waves in the financial world by announcing an unexpected venture: gold bars. As the news broke, the corporate landscape buzzed with excitement and speculation. How did a bulk-buy retail giant like Costco find itself in the gold business?

The announcement came during the eagerly anticipated earnings call for the first fiscal quarter of 2024. As the executives began to present the financial highlights, a murmur of surprise rippled through the investor community. Costco had not only surpassed expectations, but it had also achieved a remarkable feat—selling $100 million worth of gold bars.

The company’s Chief Financial Officer, Richard Galanti, shared the news during earnings call. Revealing that the gold bars had become an unexpected hit among their members. When asked about the consumer trend he said “They are buying Gold”.

During the earnings call, Martinez disclosed a 6.1% increase in sales compared to the first quarter of the previous year, showcasing the resilience and adaptability of the retail giant. The surprise didn’t stop there. The company declared a generous $15 per share dividend, further sweetening the deal for investors.

The gold bars, available exclusively to Costco members, quickly became the talk of the town. One ounce of pure 24-karat gold, limited to two bars per person, was now on the shopping list for many savvy investors. The bars were priced at $2069.99 each, making them an attractive addition to the virtual shelves of Costco’s website.

As word spread about the limited-edition gold bars, Costco’s website witnessed a surge in traffic. Members flocked online, eager to get their hands on a piece of the precious metal.

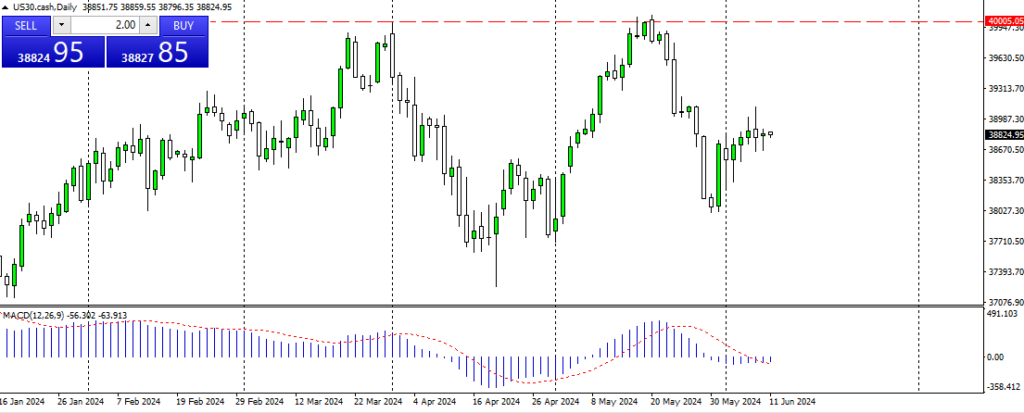

Costco’s shares responded to the unexpected success story with gusto. The stock market witnessed a flurry of activity as investors scrambled to get a piece of the action. Costco’s shares hit a record high of $661.88, marking the high of the day and showcasing the confidence the market had in the retail giant’s unconventional move.

As the closing bell rang, analysts were left in awe of Costco’s ability to innovate and captivate its audience. The unexpected foray into gold had not only diversified the company’s portfolio but had also set a precedent for retail creativity. Costco had once again proven that, whether it’s in the bulk aisle or the gold market, they knew how to capture the attention of their members and investors alike.